Fund Performance

New Haven Mortgage Income Fund (1) Inc. currently offers two share classes referred to as “MIC D” and “MIC O”. Currently in existence there are four share classes – MIC A – C – D and O. The difference between the share classes is their rules on exposure as outlined in the Offering Memorandum.

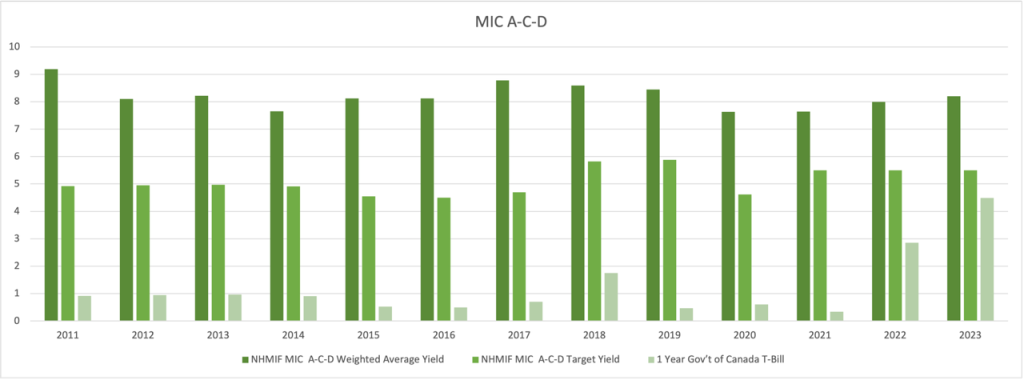

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| NHMIF MIC A-C-D Weighted Average Yield | 9.19 | 8.1 | 8.22 | 7.65 | 8.12 | 8.12 | 8.78 | 8.59 | 8.45 | 7.63 | 7.64 | 8.00 | 8.20 * |

| NHMIF MIC A-C-D Target Yield | 4.92 | 4.95 | 4.97 | 4.91 | 4.55 | 4.50 | 4.70 | 5.82 | 5.88 | 4.62 | 5.5 | 5.5 | 5.5 |

| 1 Year Gov’t of Canada T-Bill | 0.92 | 0.95 | 0.97 | 0.91 | 0.53 | 0.50 | 0.70 | 1.75 | 0.47 | 0.60 | 0.34 | 2.86 | 4.49 |

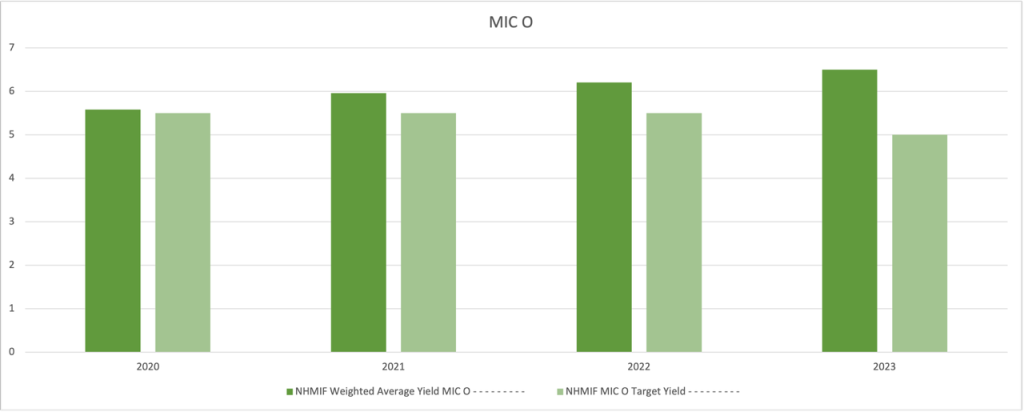

| NHMIF Weighted Average Yield MIC O | - | - | - | - | - | - | - | - | - | 5.58 | 5.96 | 6.2 | 6.5 |

| NHMIF MIC O Target Yield | - | - | - | - | - | - | - | - | - | 5.5 | 5.5 | 5.5 | 5 |

* This is not inclusive of any amendment made to Share Price and Net Asset Value as outlined in the Offering Memorandum.

There is no assurance that the historical yields shown will be representative of the yields that may or will be obtained from future mortgage investments. Yield is annualized, compounded, and net to shareholders.

This information sheet does not constitute an offer to sell nor is it a solicitation of an offer to purchase any securities of New Haven Mortgage Income Fund (1) Inc. All securities offerings carried out by New Haven Mortgage Income Fund (1) Inc.will be made to qualified purchasers in specified jurisdictions by delivery to them of formal documentation prepared specifically for the purpose of making such an offer. This will be made in compliance with applicable securities laws of the specific jurisdiction in which the offer is being made.

E.&.O.E

8.11% MIC A-C-D June 2024

6.00% MIC O June 2024